When you provide somebody a ‘Power of Attorney’ (POA) you are providing ‘agency authority:’ the power to act in your name. This suggests that they can have the lawful power to act as if they were you and do all sorts of essential stuff on your behalf.

Please wage caution: A POA can be absolutely necessary or very high-risk or both! Your designated Agent or ‘Attorney-in-Fact’ can authorize records that obligate you to points. They can relocate your cash where they such as. They have the authority to deal buildings in your name – and a lot more, depending on the boxes you may have quickly ticked on a The golden state Power of Attorney kind.

Consider a POA like a potent prescription medicine. Utilized correctly, and in the best dosage, it can get you via hard times. However if used incorrectly, abused, or given in too expensive a dosage, a POA can do irreparable injury.

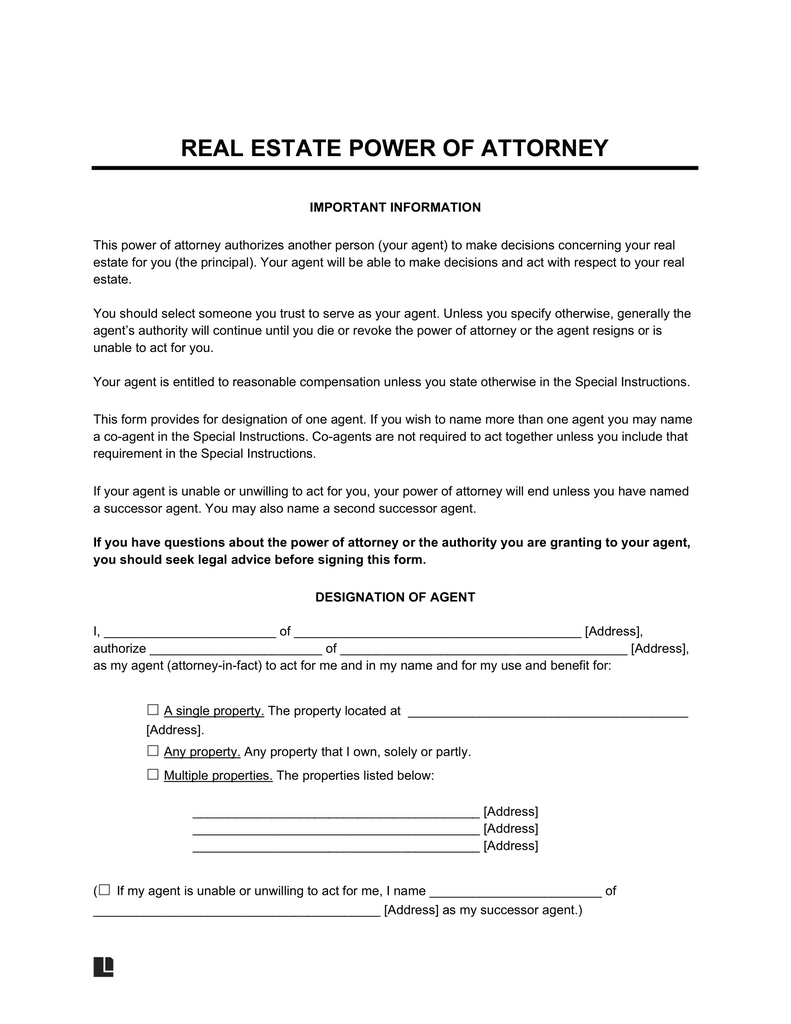

Allow’s begin by explaining that a ‘Power of Attorney’ has nothing to do with attorneys. It is a piece of paper, frequently a 2 or three-page form quickly downloaded from the net (see listed below), which you sign in front of a notary.At site Get details about California Minor Child Power of Attorney from Our Articles In that paper, you assign specific powers to your Agent. Other ‘legal representative prepared’ POAs can be greater than 30 web pages long. Legitimately, these powers are called ‘powers of attorney,’ however your Representative is not required to have any type of legal training, a family members connection, or various other duties in your Estate.

As soon as you sign a General POA, your Agent can legally act in your name without your knowledge – and without necessary oversight of any kind of court, governmental firm, Bar Association, or various other establishment.

We strongly suggest consulting with a certified lawyer before appointing powers of attorney. Call CunninghamLegal for comprehensive Estate Preparation in The Golden State.

Senior Power of Attorney Fraud

Senior people can make the error of finalizing over Powers of Lawyer to employed caretakers, undependable neighbors, ‘brand-new friends,’ and others that must never be offered such powers. This happens so much that lots of states have created Financial Elder Misuse legislations to safeguard elders and dependent grownups.

Without a doubt, individuals leaving prison are commonly suggested to end up being caretakers to the senior because the senior, or their enjoyed ones, frequently do not request background checks be finished. Enchanting former convicts might prosper in obtaining a confused senior to sign a POA giving the caregiver full powers over their funds. Various other member of the family often don’t recognize this has occurred till it is too late and possessions have been drained.

Theoretically, your Agent is legally bound as a fiduciary to act only on your behalf, but in truth, since nobody is seeing, they can basically do as they please. In my firm, we have often seen elder fraud carried out by individuals with Powers of Lawyer.

Grandmother’s New Assistant Aids Herself to a POA

Granny wishes to live alone, so the kids work hard to obtain her a complete or part-time helper to provide assistance. They call a number of references provided by Lucy and listen to just radiant reviews over the phone. Lucy is a wonderful young woman, she takes care of your home, assists Grandma with her individual requirements, and throughout six months or so, Grandma begins to feel actual love for her. Lucy starts running duties for Granny to the store and perhaps drops off down payments at the bank. Then she begins helping pay her costs. Little by little, Granny’s children begin paying less and less focus to what’s occurring, given that Lucy is doing such a terrific task.

Eventually, Lucy browses the web and downloads a Durable Power of Attorney type and moves it under Granny’s nose. She’s already marked off all packages and filled out all the details. She’s likewise brought along an unscrupulous notary. ‘Could you authorize this for me? Then I might aid foot the bill and things for you a lot much more quickly.’ Grandmother grins at the rule of having the notary existing, yet gladly indications.

The children read about none of this. But two months later Grandma’s bank account reviews $0. Her investments have been sold off and moved to numerous accounts, which were after that drained pipes and shut. ‘Lucy’ has vanished. Chance of healing? Nil.

This is not an uncommon incident. But you need to be cautious, not afraid: POAs can be used completely, not just wicked.

Do I Required a Power of Attorney in Case I Get Ill?

Despite the risks in a POA, you should consider creating a Long lasting Power of Attorney calling a truly trusted individual in case you become psychologically incapacitated or otherwise not able to act on your own behalf. Without a doubt, most of the times, in spite of the dangers, the majority of people pick to produce a Sturdy Power of Attorney as part of their Living Trust-centered estate strategy.

Without a POA in place, that would certainly pay your bills? Who would pay your taxes? Who would sign your tax return? Who would certainly handle the thousand various other legal and financial details you would certainly be unable to handle on your own?

You might be believing ‘doesn’t my living depend on take care of all that?’ The solution is no. Your trustee can authorize your specific income tax return, but can not manage your IRA and 401(k) while you are alive, and normally can not manage assets that are not in your living count on.

Any individual over 18 must take into consideration authorizing a The golden state Long lasting Power of Attorney, however make the effort to recognize the concerns extensively, make use of the best sort of POA, with the appropriate kinds of restrictions, entail close household in your choice, and get expert suggestions prior to you authorize anything.

Above all, make sure you completely understand and fully trust the individual you designate as your Agent.

Do I Required a Legal Representative to Develop Powers of Attorney?

Simply specified, you ought to constantly look for legal advice before authorizing an important, powerful file like a Sturdy Power of Attorney.

This write-up provides the various type of Powers of Lawyer in The golden state, makes clear the partnership of POAs to Depends on, explains the critical distinction between a POA Agent and a Trustee – after that invests a long time showing how a Power of Attorney is different from a Conservatorship for a senior or incapacitated person.

Along the way, I hope you will certainly recognize that these vital records, lawful connections, and life decisions ought to not be approached as diy tasks. Without qualified expert advice from a certified estate legal representative, it’s far as well very easy to make a mistake that can have awful effects on your own and your loved ones.

At my firm, CunninghamLegal, we work with households to establish the best Powers of Lawyer and other crucial Estate Preparation records, customized to private life circumstances. We have offices throughout California with experienced estate lawyers and we welcome you to contact us for assistance and guidance as you come close to these vital concerns.

Financial Power of Attorney California: What Are the Different Types of Powers of Lawyer?

There are 4 standard sort of Financial Power of Attorney – and a fifth kind just for medical care decisions. It’s critical to understand the differences and pick the ideal course – then review that path frequently.

The ‘Uniform Statutory Kind Power of Attorney’ (see below for California’s variation) is a state-specific kind that is created by a state legislature and is typically freely readily available online. These consist of common, state-approved, statutory language. However, for the most part, I advise making use of a lawyer to assist you finish the type (or formulate a custom Power of Attorney which contains details, customized language) because these forms are complex and regularly are incorrectly filled in.

- What is a General Power of Attorney? A General Power of Attorney commonly kicks in as soon as it is authorized and gives broad powers figured out in the paper, commonly by checkboxes. If I downloaded and install a General POA form from the web, wrote in your name as my Agent, checked all the boxes, and authorized it before a notary, you would instantaneously become my ‘Attorney-in-Fact,’ able to drain my checking account, sell my home, and get a car loan in my name. I would genuinely be providing you the keys to my kingdom. Unless it was a ‘Long lasting’ POA, nonetheless, the document would certainly become void as quickly as I came to be incapacitated. This can develop significant complication, which is why lots of people create a Resilient Power of Attorney even while they are well.

- What is a Resilient Power of Attorney (DPOA)? A Long Lasting Power of Attorney can be ‘General’ or restricted in range, yet it continues to be essentially (long lasting) even after you become incapacitated. A Resilient Power of Attorney is the most usual type of POA that individuals sign as part of their Estate Planning because they feel they need to provide someone the power to handle their affairs if they become incapable to represent themselves. If you don’t have a Long lasting POA in position and you come to be incapacitated, your household might need to go to court to have themselves or one more assigned as a ‘Guardian’ or ‘Conservator’ for you (a lot more on that listed below). This is a costly and time-consuming process. In The golden state, many conservatorships exceed $10,000 in fees and prices in the first year alone. Because they are one of the most typical tools, the mass of this article will manage Sturdy Powers of Attorney.

- What is a Springing Durable Power of Attorney? A Springing Sturdy POA resembles a normal Sturdy Power of Attorney, yet ‘springtimes’ right into effect either when you become incapacitated (in which instance the POA stops to work if and when you recuperate) or when you sign a Certificate of Permission that activates the POA. A Springing POA appears much safer and better in theory, but in practice it can bring about issues since your Agent will certainly need to obtain a ‘decision’ of your inability from a physician before utilizing their representative powers. This can be even more complicated by HIPAA privacy laws, and there’s always the question of what, precisely, comprises incapacity. Will others in the family agree? For these factors, lots of people simply offer a Resilient Power of Attorney, reliable when finalizing, to someone they deeply count on, or use the Certification of Permission.

- What is Unique Power of Attorney or Limited Power of Attorney in California? A Limited or Unique POA allows your attorney-in-fact (Agent) to act just in extremely details situations, for highly-specific objectives, or a restricted period. As an example, if you require a person to represent you in a legal issue while you are on holiday, you can provide an Unique Power of Attorney just for that action. Or you can give an organization companion the right to sign documents in your name while you go through a severe clinical procedure. You must absolutely see a qualified lawyer to compose such a POA.

- What is a Long Lasting Power of Attorney for Health care? In this specific POA for Health care you give a person the power to make clinical decisions (not economic or various other choices) for you when you are unable to make those choices for yourself. Some other names for comparable records are ‘Clinical POA,’ ‘Health Care Proxy,’ or ‘Advance Healthcare Directive.’ In some states, like California, health care POAs can be incorporated with a ‘Living Will’ which lays out your wishes for when you are gravely sick and close to the end of life.